5.1 Value added tax 5.2 Capital tax 5.3 Real estate tax 5.4 Transfer tax 5.5 Stamp duty 5.6 Customs and excise duties 5.7 Environmental taxes 5.8 Other taxes . How to report Federal return. from the alienation of a immovable property referred to in Article 6. and. Basis Austrian resident individuals are taxed on their worldwide income. Taxes in Austria: detailed guide on all current fees Tranio

This is one of the major benefits of investing in commercial rental property. [23] Article 5(2) of the Income Tax Act. Income in Spain is split into general (renta general) and savings (renta del ahorro) income. 8. On May 4, Washington Governor Jay Inslee (D) signed legislation ( ESSB 5096) enacting a capital gains tax equal to 7% of a Washington residents adjusted long-term capital gains. Capital gains tax does not apply if: You have owned the property for 10 years or more You have lived in the property as your primary residence for the 2 years prior to the sale This reutilisation will enable you to claim an exemption under various sections of the IT Act.

For example, on a four-hectare lot a capital gain of up to 50% may be taxable. The difference between the price you bought the property for and what you sold the property for is the capital gain.

Effective April 1 2012, this exemption was abolished. Check if your assets are subject to CGT, exempt, or pre-date CGT. You also may be required to pay estimated taxes on capital gains. Using the Pipeline: A Case Study. Capital gains tax rates on property UK are 18% for basic rate taxpayers and 28% for high rate taxpayers. The taxpayer (seller) should calculate their capital gain as if there was no relief for the sale and multiply by 7/8 (based on the example) As of the beginning of 2020, Austria is governed by a coalition of the conservative Figuring out Capital Gains Tax on Real Estate Investment Property? Non-Resident Capital Gains Tax (NRCGT) will be extended to all gains on immovable UK property from 6 April 2019, which means that from this date it will include commercial property. 55%. 6.0 Taxes on individuals.

This means if you have $1M in profits on a $2M home sale (and file your taxes jointly), you would only need to pay taxes on $500,000 worth of gains. Sell Rental Propert These assumptions are critical. Corporate tax (in detail) Capital gains tax. 48%. royalties, rental and lease income, capital gains from the disposal of shareholdings) (passive business focus), and the effective tax rate of the foreign subsidiary is 15% or lower.

The transfer of immovable property in Malta is subject to the Property Transfer Tax or PTT instead of capital gains tax. 30. In other words, the PTT is the cost of the transaction and not a tax imposed on the element of gain. $41,675 $258,600. However, you can postpone payment of this tax indefinitely as long as you use the money to buy another home in Sweden. Capital gains from the sale of business property are subject to corporate income tax of 25 percent. Capital gains on real property - Austrian tax treaty. Capital gains from the alienation of immovable property are, in principle, subject to income tax at a special rate of 30%. a spouse or child Austria Scope of Income Tax All resident companies and permanent establishments of non-resident companies are subject to corporate income tax. Taxable Income. Nationality is not in itself a criterion for determining residence or tax liability; however, it may serve as an indicator of residence in cases of doubt. Instead, any capital gain is taxed as business income, and, as such, is subject to 25% rate. Capital gains on real property - Austrian tax treaty. Private Client analysis: The non-resident capital gains tax (NRCGT) regime, introduced by Finance Act 2015, has meant that since 6 April 2015 non-UK residents have been subject to capital gains tax (CGT) when they dispose of UK residential property. Capital Gains Tax on a commercial property. As I understand it, the sale is taxable in Austria. What country has the lowest capital gains tax?Singapore. Singapore is another country with a low capital gains tax. The Cayman Islands. The Cayman Islands are the country with the lowest capital gains tax at 0%. Monaco. Monaco is the best way to enjoy the lowest capital gains tax! Belgium. Malaysia. New Zealand. Norway. Belize. Ireland. Mauritius. More items Trust interests are also eligible to be included. California return. situated in the Other Contracting State.

James Dudbridge, associate at Burges Salmon LLP, reflects on the changes, one year on. under the austrian capital gains regulations effective since 1 april 2012, capital gains resulting from sales of shares (including qualifying participation's), securities, or other financial assets (e.g.

The first is in relation to the NSW properties, where there is a potential loss on the 50% capital gains tax discount from 8 May 2012 to capital gains made by a non-resident. The first $500,000 of the gain is tax-free, and the remaining $275,000 is subject to capital gains tax rates of 15% or 20%, depending on your income, plus a 3.8% surtax for upper-income individuals. Married filing separately. The standard rate of capital gains tax is set at ten percent for assets other than residential property, with two figures combined that are below the basic rate threshold. In 2017, residents pay tax on savings income progressively at 19% (0-6,000), 21% (6,000-50,000) and 23% (over 50,000). Property taxes apply to assets of an individual or a business.

Austria has a number of other types of taxation, these include the following: Capital gains tax ( Kapitalertragsteuer) the tax rate is equal to 25%. The two most common CGT events for property are: Disposal of a CGT asset. California does not have a lower rate for capital gains. Refer to Opting out of Property transfer Tax with regards to the possible instances when capital gains tax is used instead of property transfer tax. Capital gains taxes in France. Capital gains tax on other assets is also split into a basic rate and higher rate, but the rates are lower, at 10 per cent and 20 per cent respectively. A capital gains tax ( CGT) is a tax on the profit realized on the sale of a non-inventory asset. In brief. Capital gains (on both investments and property) are treated as savings income. Part usage rules.

1: The simplest way of saving your capital gain is to buy another property. Austria. VAT. Since 2021, when you sell a property in Portugal, residents pay taxes on only 50% of their gains. Proceeds of disposition: The value of the asset at the time of saleAdjusted cost base (ACB): The amount originally paidOutlays and expenses: Total of costs deemed necessary before selling, such as renovations and maintenance expenses, finders fees, commissions, brokers fees, surveyors fees, legal fees, transfer taxes and advertising costs Individual - Residence. The tax is set at 8% of the selling price or transfer value, yet there are a few exceptions for properties acquired before 2004.

You add $100,000 to your taxable income for the year. The recent passage of the Tax Cuts and Jobs Act (TCJA) increased interest in C Corporations. Capital gains tax is of two types- Short-Term Capital Gains (STCG) for a property held for less than 36 months and Long-Term Capital Gains (LTCG) for above 36 months. As I understand it, the sale is taxable in Austria.

Find out if your granny flat arrangement is exempt from CGT. from self-employed work. There is no specific capital gains tax in Austria. above 1,000,000.

In Austria there is a progressive rate of income tax (0-50%). Lets say you bought the property for $100,000 and you sold it for $125,000. Basis Residents are taxed on worldwide income; nonresidents are taxed only on Austrian-source income. An option exists for taxation at marginal income tax rates. 1 % of the assessed value (Einheitswert), which is regularly beneath the actual value. Capital Gains Tax Rates in Europe. Financial Transactional Tax. You may qualify for long-term capital gains rates of 0%, 15% or 20%, depending on taxable income, if you hold the currency for more than one year. However, selling or exchanging assets after less than one year triggers short-term capital gains, with regular income tax rates, up to 37% for top earners. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property .

15. 33. Corporate Income Tax Rates in Europe. Czech Republic. Capital gains tax. To those who live in/ from Austria, where do you find the tax codes regarding capital gains? Branch tax rate 25% Capital gains tax rate 0%/25% Residence A corporation is resident if it is incorporated in Austria or managed and controlled in Austria. Property tax - Charged to the buyer at 0.4% to 0.9% of the property value Wealth tax 1% of the buyer's net worth Capital gains tax - 50% The capital gains tax is only applicable if a property is sold within 10 years of purchase for a profit.

This is one of the major benefits of investing in commercial rental property. [23] Article 5(2) of the Income Tax Act. Income in Spain is split into general (renta general) and savings (renta del ahorro) income. 8. On May 4, Washington Governor Jay Inslee (D) signed legislation ( ESSB 5096) enacting a capital gains tax equal to 7% of a Washington residents adjusted long-term capital gains. Capital gains tax does not apply if: You have owned the property for 10 years or more You have lived in the property as your primary residence for the 2 years prior to the sale This reutilisation will enable you to claim an exemption under various sections of the IT Act.

This is one of the major benefits of investing in commercial rental property. [23] Article 5(2) of the Income Tax Act. Income in Spain is split into general (renta general) and savings (renta del ahorro) income. 8. On May 4, Washington Governor Jay Inslee (D) signed legislation ( ESSB 5096) enacting a capital gains tax equal to 7% of a Washington residents adjusted long-term capital gains. Capital gains tax does not apply if: You have owned the property for 10 years or more You have lived in the property as your primary residence for the 2 years prior to the sale This reutilisation will enable you to claim an exemption under various sections of the IT Act.  For example, on a four-hectare lot a capital gain of up to 50% may be taxable. The difference between the price you bought the property for and what you sold the property for is the capital gain.

For example, on a four-hectare lot a capital gain of up to 50% may be taxable. The difference between the price you bought the property for and what you sold the property for is the capital gain.

Effective April 1 2012, this exemption was abolished. Check if your assets are subject to CGT, exempt, or pre-date CGT. You also may be required to pay estimated taxes on capital gains. Using the Pipeline: A Case Study. Capital gains tax rates on property UK are 18% for basic rate taxpayers and 28% for high rate taxpayers. The taxpayer (seller) should calculate their capital gain as if there was no relief for the sale and multiply by 7/8 (based on the example) As of the beginning of 2020, Austria is governed by a coalition of the conservative Figuring out Capital Gains Tax on Real Estate Investment Property? Non-Resident Capital Gains Tax (NRCGT) will be extended to all gains on immovable UK property from 6 April 2019, which means that from this date it will include commercial property. 55%. 6.0 Taxes on individuals.

Effective April 1 2012, this exemption was abolished. Check if your assets are subject to CGT, exempt, or pre-date CGT. You also may be required to pay estimated taxes on capital gains. Using the Pipeline: A Case Study. Capital gains tax rates on property UK are 18% for basic rate taxpayers and 28% for high rate taxpayers. The taxpayer (seller) should calculate their capital gain as if there was no relief for the sale and multiply by 7/8 (based on the example) As of the beginning of 2020, Austria is governed by a coalition of the conservative Figuring out Capital Gains Tax on Real Estate Investment Property? Non-Resident Capital Gains Tax (NRCGT) will be extended to all gains on immovable UK property from 6 April 2019, which means that from this date it will include commercial property. 55%. 6.0 Taxes on individuals.  This means if you have $1M in profits on a $2M home sale (and file your taxes jointly), you would only need to pay taxes on $500,000 worth of gains. Sell Rental Propert These assumptions are critical. Corporate tax (in detail) Capital gains tax. 48%. royalties, rental and lease income, capital gains from the disposal of shareholdings) (passive business focus), and the effective tax rate of the foreign subsidiary is 15% or lower.

This means if you have $1M in profits on a $2M home sale (and file your taxes jointly), you would only need to pay taxes on $500,000 worth of gains. Sell Rental Propert These assumptions are critical. Corporate tax (in detail) Capital gains tax. 48%. royalties, rental and lease income, capital gains from the disposal of shareholdings) (passive business focus), and the effective tax rate of the foreign subsidiary is 15% or lower.  The transfer of immovable property in Malta is subject to the Property Transfer Tax or PTT instead of capital gains tax. 30. In other words, the PTT is the cost of the transaction and not a tax imposed on the element of gain. $41,675 $258,600. However, you can postpone payment of this tax indefinitely as long as you use the money to buy another home in Sweden. Capital gains from the sale of business property are subject to corporate income tax of 25 percent. Capital gains on real property - Austrian tax treaty. Capital gains from the alienation of immovable property are, in principle, subject to income tax at a special rate of 30%. a spouse or child Austria Scope of Income Tax All resident companies and permanent establishments of non-resident companies are subject to corporate income tax. Taxable Income. Nationality is not in itself a criterion for determining residence or tax liability; however, it may serve as an indicator of residence in cases of doubt. Instead, any capital gain is taxed as business income, and, as such, is subject to 25% rate. Capital gains on real property - Austrian tax treaty. Private Client analysis: The non-resident capital gains tax (NRCGT) regime, introduced by Finance Act 2015, has meant that since 6 April 2015 non-UK residents have been subject to capital gains tax (CGT) when they dispose of UK residential property. Capital Gains Tax on a commercial property. As I understand it, the sale is taxable in Austria. What country has the lowest capital gains tax?Singapore. Singapore is another country with a low capital gains tax. The Cayman Islands. The Cayman Islands are the country with the lowest capital gains tax at 0%. Monaco. Monaco is the best way to enjoy the lowest capital gains tax! Belgium. Malaysia. New Zealand. Norway. Belize. Ireland. Mauritius. More items Trust interests are also eligible to be included. California return. situated in the Other Contracting State.

The transfer of immovable property in Malta is subject to the Property Transfer Tax or PTT instead of capital gains tax. 30. In other words, the PTT is the cost of the transaction and not a tax imposed on the element of gain. $41,675 $258,600. However, you can postpone payment of this tax indefinitely as long as you use the money to buy another home in Sweden. Capital gains from the sale of business property are subject to corporate income tax of 25 percent. Capital gains on real property - Austrian tax treaty. Capital gains from the alienation of immovable property are, in principle, subject to income tax at a special rate of 30%. a spouse or child Austria Scope of Income Tax All resident companies and permanent establishments of non-resident companies are subject to corporate income tax. Taxable Income. Nationality is not in itself a criterion for determining residence or tax liability; however, it may serve as an indicator of residence in cases of doubt. Instead, any capital gain is taxed as business income, and, as such, is subject to 25% rate. Capital gains on real property - Austrian tax treaty. Private Client analysis: The non-resident capital gains tax (NRCGT) regime, introduced by Finance Act 2015, has meant that since 6 April 2015 non-UK residents have been subject to capital gains tax (CGT) when they dispose of UK residential property. Capital Gains Tax on a commercial property. As I understand it, the sale is taxable in Austria. What country has the lowest capital gains tax?Singapore. Singapore is another country with a low capital gains tax. The Cayman Islands. The Cayman Islands are the country with the lowest capital gains tax at 0%. Monaco. Monaco is the best way to enjoy the lowest capital gains tax! Belgium. Malaysia. New Zealand. Norway. Belize. Ireland. Mauritius. More items Trust interests are also eligible to be included. California return. situated in the Other Contracting State.

The first is in relation to the NSW properties, where there is a potential loss on the 50% capital gains tax discount from 8 May 2012 to capital gains made by a non-resident. The first $500,000 of the gain is tax-free, and the remaining $275,000 is subject to capital gains tax rates of 15% or 20%, depending on your income, plus a 3.8% surtax for upper-income individuals. Married filing separately. The standard rate of capital gains tax is set at ten percent for assets other than residential property, with two figures combined that are below the basic rate threshold. In 2017, residents pay tax on savings income progressively at 19% (0-6,000), 21% (6,000-50,000) and 23% (over 50,000). Property taxes apply to assets of an individual or a business.

The first is in relation to the NSW properties, where there is a potential loss on the 50% capital gains tax discount from 8 May 2012 to capital gains made by a non-resident. The first $500,000 of the gain is tax-free, and the remaining $275,000 is subject to capital gains tax rates of 15% or 20%, depending on your income, plus a 3.8% surtax for upper-income individuals. Married filing separately. The standard rate of capital gains tax is set at ten percent for assets other than residential property, with two figures combined that are below the basic rate threshold. In 2017, residents pay tax on savings income progressively at 19% (0-6,000), 21% (6,000-50,000) and 23% (over 50,000). Property taxes apply to assets of an individual or a business.  Austria has a number of other types of taxation, these include the following: Capital gains tax ( Kapitalertragsteuer) the tax rate is equal to 25%. The two most common CGT events for property are: Disposal of a CGT asset. California does not have a lower rate for capital gains. Refer to Opting out of Property transfer Tax with regards to the possible instances when capital gains tax is used instead of property transfer tax. Capital gains taxes in France. Capital gains tax on other assets is also split into a basic rate and higher rate, but the rates are lower, at 10 per cent and 20 per cent respectively. A capital gains tax ( CGT) is a tax on the profit realized on the sale of a non-inventory asset. In brief. Capital gains (on both investments and property) are treated as savings income. Part usage rules.

Austria has a number of other types of taxation, these include the following: Capital gains tax ( Kapitalertragsteuer) the tax rate is equal to 25%. The two most common CGT events for property are: Disposal of a CGT asset. California does not have a lower rate for capital gains. Refer to Opting out of Property transfer Tax with regards to the possible instances when capital gains tax is used instead of property transfer tax. Capital gains taxes in France. Capital gains tax on other assets is also split into a basic rate and higher rate, but the rates are lower, at 10 per cent and 20 per cent respectively. A capital gains tax ( CGT) is a tax on the profit realized on the sale of a non-inventory asset. In brief. Capital gains (on both investments and property) are treated as savings income. Part usage rules.  1: The simplest way of saving your capital gain is to buy another property. Austria. VAT. Since 2021, when you sell a property in Portugal, residents pay taxes on only 50% of their gains. Proceeds of disposition: The value of the asset at the time of saleAdjusted cost base (ACB): The amount originally paidOutlays and expenses: Total of costs deemed necessary before selling, such as renovations and maintenance expenses, finders fees, commissions, brokers fees, surveyors fees, legal fees, transfer taxes and advertising costs Individual - Residence. The tax is set at 8% of the selling price or transfer value, yet there are a few exceptions for properties acquired before 2004.

1: The simplest way of saving your capital gain is to buy another property. Austria. VAT. Since 2021, when you sell a property in Portugal, residents pay taxes on only 50% of their gains. Proceeds of disposition: The value of the asset at the time of saleAdjusted cost base (ACB): The amount originally paidOutlays and expenses: Total of costs deemed necessary before selling, such as renovations and maintenance expenses, finders fees, commissions, brokers fees, surveyors fees, legal fees, transfer taxes and advertising costs Individual - Residence. The tax is set at 8% of the selling price or transfer value, yet there are a few exceptions for properties acquired before 2004.  You add $100,000 to your taxable income for the year. The recent passage of the Tax Cuts and Jobs Act (TCJA) increased interest in C Corporations. Capital gains tax is of two types- Short-Term Capital Gains (STCG) for a property held for less than 36 months and Long-Term Capital Gains (LTCG) for above 36 months. As I understand it, the sale is taxable in Austria.

You add $100,000 to your taxable income for the year. The recent passage of the Tax Cuts and Jobs Act (TCJA) increased interest in C Corporations. Capital gains tax is of two types- Short-Term Capital Gains (STCG) for a property held for less than 36 months and Long-Term Capital Gains (LTCG) for above 36 months. As I understand it, the sale is taxable in Austria.  Find out if your granny flat arrangement is exempt from CGT. from self-employed work. There is no specific capital gains tax in Austria. above 1,000,000.

Find out if your granny flat arrangement is exempt from CGT. from self-employed work. There is no specific capital gains tax in Austria. above 1,000,000.  In Austria there is a progressive rate of income tax (0-50%). Lets say you bought the property for $100,000 and you sold it for $125,000. Basis Residents are taxed on worldwide income; nonresidents are taxed only on Austrian-source income. An option exists for taxation at marginal income tax rates. 1 % of the assessed value (Einheitswert), which is regularly beneath the actual value. Capital Gains Tax Rates in Europe. Financial Transactional Tax. You may qualify for long-term capital gains rates of 0%, 15% or 20%, depending on taxable income, if you hold the currency for more than one year. However, selling or exchanging assets after less than one year triggers short-term capital gains, with regular income tax rates, up to 37% for top earners. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property .

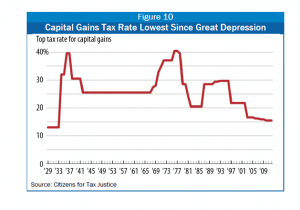

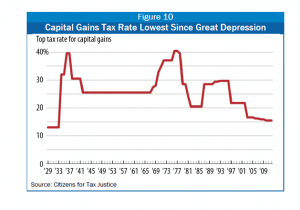

In Austria there is a progressive rate of income tax (0-50%). Lets say you bought the property for $100,000 and you sold it for $125,000. Basis Residents are taxed on worldwide income; nonresidents are taxed only on Austrian-source income. An option exists for taxation at marginal income tax rates. 1 % of the assessed value (Einheitswert), which is regularly beneath the actual value. Capital Gains Tax Rates in Europe. Financial Transactional Tax. You may qualify for long-term capital gains rates of 0%, 15% or 20%, depending on taxable income, if you hold the currency for more than one year. However, selling or exchanging assets after less than one year triggers short-term capital gains, with regular income tax rates, up to 37% for top earners. The most common capital gains are realized from the sale of stocks, bonds, precious metals, real estate, and property .  15. 33. Corporate Income Tax Rates in Europe. Czech Republic. Capital gains tax. To those who live in/ from Austria, where do you find the tax codes regarding capital gains? Branch tax rate 25% Capital gains tax rate 0%/25% Residence A corporation is resident if it is incorporated in Austria or managed and controlled in Austria. Property tax - Charged to the buyer at 0.4% to 0.9% of the property value Wealth tax 1% of the buyer's net worth Capital gains tax - 50% The capital gains tax is only applicable if a property is sold within 10 years of purchase for a profit.

15. 33. Corporate Income Tax Rates in Europe. Czech Republic. Capital gains tax. To those who live in/ from Austria, where do you find the tax codes regarding capital gains? Branch tax rate 25% Capital gains tax rate 0%/25% Residence A corporation is resident if it is incorporated in Austria or managed and controlled in Austria. Property tax - Charged to the buyer at 0.4% to 0.9% of the property value Wealth tax 1% of the buyer's net worth Capital gains tax - 50% The capital gains tax is only applicable if a property is sold within 10 years of purchase for a profit.