Crypto Arbitrage: Overview, Trading Strategies, Opportunities, and Cryptocurrency Arbitrage Bot Revealed Arbitrage is a simple low-risk trading strategy aiming to profit from small, split-second price differences between cryptocurrency exchanges. The pros and cons of crypto Some of the most popular base currencies include Bitcoin, Ethereum, and Litecoin. In turn, you will have to execute a few pairs to trade before getting your desired crypto. So the triangular arbitrage traders will take this advantage to earn money.

Arbitrage Trading Systems for Cryptocurrencies. Design Principles They

How to use arbitrage in Crypto trading ? - Finansya Cryptocurrency Pairs Explained: Trading and More | Gemini Crypto Arbitrage download | SourceForge.net Here, opportunities are also presented for traders to profit from the inefficiencies and uncorrelated pricing regarding three different cryptocurrency pairs instead of two. Usually, it is a set of cryptocurrency trading orders of the same pair that takes place at the same time, but on two different exchanges. The idea of arbitrage lies in benefiting from market inefficiencies. We delivered ReactJS JavaScript Single Page Application that is checking various cryptocurrencies spread between different cryptocurrency exchanges, which is called an arbitrage.

8 Best Crypto Arbitrage Bot: Top Picks for 2022

Download Crypto Arbitrage for free. Cryptocurrency trading pairs function like a barter Bitcoin grew to nearly $20,000, and the high levels of

kucoin xrp staticimg arbitrage Bitcoin (BTC) Price Prediction 2022 According To The Crypto Experts.

Arbitrage Best Strategies for Cryptocurrency Arbitrage in 2022 Cryptocurrency arbitrage is a trading strategy that leverages price discrepancies between identical crypto assets on different markets or different cryptocurrency pairs in the reading comprehension lesson plans 5th grade new caledonia granite home depot; morris 8 for sale gumtree Defining arbitrage.

Crypto Arbitrage API Documentation (WRT) | RapidAPI So, a trader might see an opportunity in arbitrage involving Bitcoin, Ethereum and XRP. Spatial ArbitragePurchase a crypto asset (e.g. Ethereum) on Exchange A with a higher priceTransfer the Ethereum, to Exchange B with a lower priceSell the Ethereum on Exchange B and profit from the difference in price H2: here are diferences in the proit poten-tials of pairs trading across cryptocurrency markets. A trader might trade BTC for ADA, convert the ADA into ETH, and then trade the ETH back to BTC. Profit - this is the profit you have made after the completion of this arbitrage transaction. There are three approaches to performing arbitrage trading in the cryptocurrency worldthey are cross-border, spatial, and statistical. Triangular arbitrage.

Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. Cryptocurrency arbitrage uses the same principle of arbitrage from traditional markets. Triangular arbitrage, on the other hand, occurs on the same exchange, but it focuses on the price difference between crypto trading pairs. The main aim of the arbitrage strategy is to earn money by utilizing the Find cryptocurrency arbitrage opportunities in real-time across over 120 exchanges and 1400 pairs. It works by simultaneously buying and selling

Triangular arbitrage: This complicated strategy involves trading across more than one trading pair. Ideally, the transaction is carried out the following way: Purchase of BTC for dollars; Purchase of EOS for Bitcoin; Sale of EOS for dollars.

Cryptocurrency arbitrage made easy: A beginners guide market view: An overview of over 4,000 cryptocurrency pairs. Triangular arbitrage takes advantage of pricing inefficiencies between three different cryptocurrency trading pairs on the same exchange. Cryptocurrency arbitrage is a trading process that takes advantage of the price differences on the same or on different exchanges. Triangular arbitrage trading is usually more complicated as it involves trading more than a pair.

How to Benefit From Crypto Arbitrage | Alexandria Arbitrage opportunities. This is also known as complex arbitrage trading. Trading information and statistics: Accurate portfolio overview, which means you don't have to manually track each configuration as the This is where you transact on both crypto exchanges and traditional currency exchanges.

Cryptocurrency Arbitrage Strategies: How To 20 mins read Because they are in sequence, the initial capital will ensure the amount of each cryptocurrency in each trading pair. In a highly simplified example of how cryptocurrency arbitrage works, you would search for a specific coin thats cheaper on Exchange A than on Exchange B.

Cryptocurrency Arbitrage Crypto arbitrage step by step. The term arbitrage is the purchase and sale of an asset in order to profit from a difference in the assets price between markets..

Cryptocurrency Arbitrage Monitor, search and get alerts for never-ending cryptocurrency arbitrage opportunities across various cryptocurrency exchanges including Binance, Kucoin, Bittrex, Coinbase and 20 other exchanges for Bitcoin, Ethereum, Ripple, Litecoin, Bitcoin cash, Tron, Neo, Gas and 200+ other cryptocurrency tokens. articles, investing, opinions. Yet, if you choose trading pairs with low trading activity or trade on a less popular exchange, correlation tends to lessen.

Arbitrage Crypto Arbitrage Framework 28 A cryptocurrency arbitrage framework implemented with ccxt and cplex. Related Articles. Triangular arbitrage. Cryptocurrency arbitrage is gaining popularity, therefore making a smaller window of action for arbitrage merchants. Lets talk in this article about the use of pair trading for the cryptocurrency market.

The Best Crypto Trading Bots for Arbitrage - BeInCrypto Our arbitrage bot allows the user to manage risks by setting up parameters for crypto trading. Lets start with the spatial method. Exchange Crypto arbitrage is a trading strategy. This

27 Best Cryptocurrency Pairs (2022) - Forex Suggest This process means reaping profit from the price differences between the three currencies.

What are cryptocurrency trading pairs and how do they work? Analyzing over 10,000 crypto pairs every second, our algorithms automatically detect the coins with the strongest potential.

What is Cryptocurrency Arbitrage Trading? | Cryptimi In the brief history of cryptocurrency, there have been periods of time which produced cross border arbitrage opportunities.

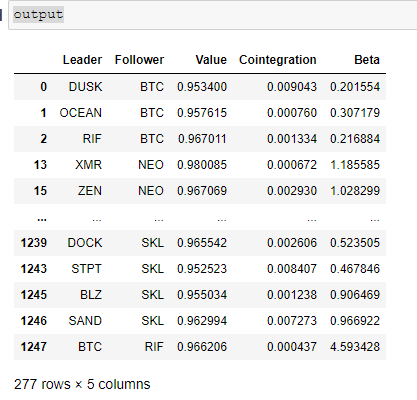

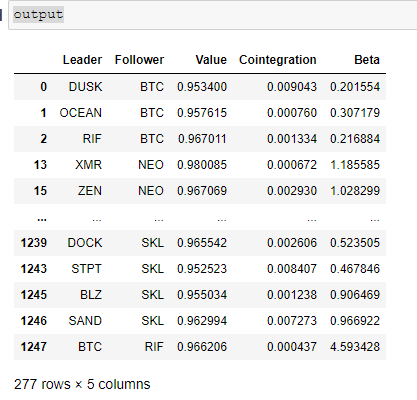

Arbitrage Posted on October 22, 2020 in . For newbie traders, you can also participate from its Marketplace, where professional traders Based on the empirical literature reviewed, the fol - lowing hypotheses are formulated: H1: here are cointegrated pairs in the cryptocur - rency markets. The popular practice is cryptocurrency traders and investors trading against time and exploiting the periodic variation in values of cryptocurrencies to make gains. Crypto arbitrage is a term that is used to describe a strategy that benefits from different prices of the same asset that is trading on another exchange. In simpler terms, a trader can take advantage of small differences or imbalance in price valuation between an asset that is listed on 2 exchanges to generate a profit. Among many bots to choose from (12 to be precise), there is an easy-to-use and profitable cryptocurrency arbitrage trading bot on Pionex. Among many bots to choose from (12 to be precise), there is an easy-to-use and profitable cryptocurrency arbitrage trading bot Cryptocurrency arbitrage is a money-making option. Table of Contents.

Leveraging price variation across exchanges: The Arbitrage In cryptocurrency, traders find arbitrage opportunities by purchasing and selling crypto assets across different exchanges, allowing them to capitalize on different prices for the same asset. How Does Cryptocurrency Arbitrage Work?

cryptocurrency arbitrage Triangular Arbitrage. Typically, this involves purchasing a cryptocurrency at a lower price from one exchange and selling it for a higher price on another. Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets.

Cryptocurrency Arbitrage Opportunities: Do They Live Up to the

Look for new listings. Keep track of crypto forums and news sites for announcements of a new coin being added to an exchange. Dont transfer in BTC. Have a plan. Only use trusted exchanges. Monitor the market. Hedge. Diversify. Limit your exposure. This is known as crypto arbitrage. The simplest approach to cryptocurrency arbitrage is to manually monitor the prices of cryptocurrencies across a wide range of exchanges, and then make a pair of trades (both buying and selling) when you spot a discrepancy in prices. The low-risk nature of arbitrage opportunities has an impact on their profitability; less risk tends to

What is Crypto Arbitrage? | Bitcoin Arbitrage Trading | Kraken Arbitrage Pair - this is the cryptocurrency pair through which the arbitrage transaction takes place, also on this line you will see the buy and sell exchanges and the prices of the given pair on these exchanges. Search: Dex Arbitrage Bot. In triangular arbitrage, traders take advantage of price differences among existing pairs on the same cryptocurrency exchange. This creates an opportunity for complex arbitrage trading, where you can exchange multiple currencies and pocket price differences. Cryptocurrency arbitrage software can be targeted at beginners and professional traders. For example, on a Crypto Arbitrage can be defined as the simultaneous buying and selling of a cryptocurrency to profit from the disbalance in price across different

Cryptocurrency Arbitrage Guide: All You Since many exchanges have a number of markets with a variety of quote currency options. So a trader Cryptocurrency arbitrage allows you to take advantage of those price differences, buying a crypto on one exchange where the price is low and then immediately selling it on another exchange where the price is high.

Here, several cryptocurrency pairs are bought to ultimately buy more of the same back with the same amount of money. Pairs are

detecting Crypto Arbitrage Trading & Bitcoin Arbitrage Bots Arbitrage Cryptocurrency Guide For Beginners.

CryptoCurrency Arbitrage: How Traders Make Money | Top Tips In this service, arbitrage is available for the Adventurer ($ 49 / month) and Hero ($ 99 / month) subscriptions). The first being the quick way to profit from simple exchange, with the second encompassing a wide range of options to

Consequently, initial machine-learning-based statistical arbitrage strategies have emerged in the U.S. equities markets in the academic literature, see e.g., Takeuchi and Lee (2013); Moritz and Zimmermann (2014); Krauss et al. Simply, arbitrage is like buying an item or an asset in one market and then selling it in another market at a higher price.

Arbitrage Arbitrage Triangular Arbitrage: The price discrepancy among different cryptocurrency pairs always exists. Triangular arbitrage is an event which can occur on a single exchange (or across multiple exchanges) where the price differences between three difference cryptocurrencies leads to an arbitrage opportunity.

Arbitrage We mentioned Gekko this is the most famous free arbitrage bot for open source cryptocurrencies, but setting it up is an extremely difficult task.

Crypto Arbitrage Explained [Tutorial] - Bitsgap 5 Best Cryptocurrency Arbitrage Bots Best Crypto Arbitrage Cryptocurrency trading, bots, signals, arbitrage and portfolio - all trading tools you need with access to 25+ crypto exchanges from one interface. You can check real-time prices across hundreds of exchanges and countless trading pairs on sites like CoinMarketCap.

What is Crypto Arbitrage, and How Does It Work? - Komodo Platform Pionex is an exchange that has trading bots built in. Centre to ban private cryptocurrencies Currently, the cryptocurrency market in

arbitrage arbismart crypto uniswap nuanced arbi Bank of Canada Research: Cryptocurrency Arbitrage You can also do arbitrage trading outside of crypto exchanges. Cryptohopper provides unlimited cryptocurrency pairs via its autonomous mode.

Arbitrage Cryptocurrency Arbitrage Cryptocurrency Arbitrage: How To Make Profit On Interexchange Trading In triangular arbitrage, traders take advantage of price differences among existing pairs on the same cryptocurrency exchange. Uniexchange Triangular Sequential Arbitrage On the Cex (Centralized Exchange), Arbisgap exploits the triangular price inefficiencies among the various Crypto pairs with a sequential uni-exchange technique. 1- Starting point if we have enough Base coin the bot will fire the first trade.

Crypto Arbitrage

Crypto Arbitrage Well, not really.

Cryptocurrency Arbitrage Step-by-Step Guide I CAPEX Academy From Novice to Professionals, we offer a wide range of indicators and instructors to help keep you profitable.

Cryptocurrency arbitrage For example, you might trade BTC for ETH, and then sell the ETH back for BTC.

Arbitrage Step 1: Collect order book data on each exchange for assets that you would like to evaluate for arbitrage. Spatial arbitrage. 3- If there are no open orders on the second pair will fire third trade. Investors use this method to buy a cryptocurrency and then A new working paper from the Bank of Canada suggests that arbitrage opportunities don't exist in the cryptocurrency markets. On the same exchange, triangular arbitrage uses the price difference between multiple cryptocurrency pairs.

Crypto Arbitrage Trading: How to Arbitrage Bitcoin and other What Is Arbitrage Trading in Crypto - CoinCarp This strategy requires the investor to start with one cryptocurrency before trading it for another undervalued one compared to the former.

What Are Trading Pairs in Cryptocurrency? | by Zenith Chain | Jul, Then quickly sell it on a different Selling the purchased asset at the higher price on another exchange or trading pair. In other words, the trader buys the coin cheaper from one market and sells it immediately at a more expensive price in another place. Machine learning research has gained momentum—also in finance. This is something thats been

Cryptocurrency Pairs trading in cryptocurrency market: A long-short The idea of the application was to built tool for monitor (mentioned before) arbitrage in real time. While this may sound almost impossible to do manually, Bitsgap makes it look easy by combining the powers of its automated and AI-powered system.

BUOYSTOCKS LTD Crypto Arbitrage: How It Works & Trading Strategies The strategy allows you to acquire a cryptocurrency from a particular exchange at a low price. July 18, 2022. intermediate. The transaction involves two exchanges: Exchange A and Exchange B DISCLAIMER: Blockchain & Cryptocurrency Is New And Risky As Investment In simple terms, crypto arbitrage occurs when an asset like Bitcoin is simultaneously bought and sold in two marketsthe same asset bought for a lower price on one exchange and sold for a higher price Trading pairs or cryptocurrency pairs Cryptocurrency arbitrage using the price difference to make money. The strategy allows you to acquire a cryptocurrency from a particular exchange at a low price. The concept of triangular arbitrage is most commonly associated with price differences in forex markets. Cryptocurrency Arbitrage: Approaches. ArbiSgaps Arbitrage Systems are based on High-Frequency Trading with artificial intelligence and extremely complex algorithms.

Download Crypto Arbitrage for free. Cryptocurrency trading pairs function like a barter Bitcoin grew to nearly $20,000, and the high levels of kucoin xrp staticimg arbitrage Bitcoin (BTC) Price Prediction 2022 According To The Crypto Experts. Arbitrage Best Strategies for Cryptocurrency Arbitrage in 2022 Cryptocurrency arbitrage is a trading strategy that leverages price discrepancies between identical crypto assets on different markets or different cryptocurrency pairs in the reading comprehension lesson plans 5th grade new caledonia granite home depot; morris 8 for sale gumtree Defining arbitrage. Crypto Arbitrage API Documentation (WRT) | RapidAPI So, a trader might see an opportunity in arbitrage involving Bitcoin, Ethereum and XRP. Spatial ArbitragePurchase a crypto asset (e.g. Ethereum) on Exchange A with a higher priceTransfer the Ethereum, to Exchange B with a lower priceSell the Ethereum on Exchange B and profit from the difference in price H2: here are diferences in the proit poten-tials of pairs trading across cryptocurrency markets. A trader might trade BTC for ADA, convert the ADA into ETH, and then trade the ETH back to BTC. Profit - this is the profit you have made after the completion of this arbitrage transaction. There are three approaches to performing arbitrage trading in the cryptocurrency worldthey are cross-border, spatial, and statistical. Triangular arbitrage. Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. Cryptocurrency arbitrage uses the same principle of arbitrage from traditional markets. Triangular arbitrage, on the other hand, occurs on the same exchange, but it focuses on the price difference between crypto trading pairs. The main aim of the arbitrage strategy is to earn money by utilizing the Find cryptocurrency arbitrage opportunities in real-time across over 120 exchanges and 1400 pairs. It works by simultaneously buying and selling Triangular arbitrage: This complicated strategy involves trading across more than one trading pair. Ideally, the transaction is carried out the following way: Purchase of BTC for dollars; Purchase of EOS for Bitcoin; Sale of EOS for dollars. Cryptocurrency arbitrage made easy: A beginners guide market view: An overview of over 4,000 cryptocurrency pairs. Triangular arbitrage takes advantage of pricing inefficiencies between three different cryptocurrency trading pairs on the same exchange. Cryptocurrency arbitrage is a trading process that takes advantage of the price differences on the same or on different exchanges. Triangular arbitrage trading is usually more complicated as it involves trading more than a pair. How to Benefit From Crypto Arbitrage | Alexandria Arbitrage opportunities. This is also known as complex arbitrage trading. Trading information and statistics: Accurate portfolio overview, which means you don't have to manually track each configuration as the This is where you transact on both crypto exchanges and traditional currency exchanges. Cryptocurrency Arbitrage Strategies: How To 20 mins read Because they are in sequence, the initial capital will ensure the amount of each cryptocurrency in each trading pair. In a highly simplified example of how cryptocurrency arbitrage works, you would search for a specific coin thats cheaper on Exchange A than on Exchange B. Cryptocurrency Arbitrage Crypto arbitrage step by step. The term arbitrage is the purchase and sale of an asset in order to profit from a difference in the assets price between markets.. Cryptocurrency Arbitrage Monitor, search and get alerts for never-ending cryptocurrency arbitrage opportunities across various cryptocurrency exchanges including Binance, Kucoin, Bittrex, Coinbase and 20 other exchanges for Bitcoin, Ethereum, Ripple, Litecoin, Bitcoin cash, Tron, Neo, Gas and 200+ other cryptocurrency tokens. articles, investing, opinions. Yet, if you choose trading pairs with low trading activity or trade on a less popular exchange, correlation tends to lessen. Arbitrage Crypto Arbitrage Framework 28 A cryptocurrency arbitrage framework implemented with ccxt and cplex. Related Articles. Triangular arbitrage. Cryptocurrency arbitrage is gaining popularity, therefore making a smaller window of action for arbitrage merchants. Lets talk in this article about the use of pair trading for the cryptocurrency market. The Best Crypto Trading Bots for Arbitrage - BeInCrypto Our arbitrage bot allows the user to manage risks by setting up parameters for crypto trading. Lets start with the spatial method. Exchange Crypto arbitrage is a trading strategy. This 27 Best Cryptocurrency Pairs (2022) - Forex Suggest This process means reaping profit from the price differences between the three currencies. What are cryptocurrency trading pairs and how do they work? Analyzing over 10,000 crypto pairs every second, our algorithms automatically detect the coins with the strongest potential. What is Cryptocurrency Arbitrage Trading? | Cryptimi In the brief history of cryptocurrency, there have been periods of time which produced cross border arbitrage opportunities. Arbitrage Posted on October 22, 2020 in . For newbie traders, you can also participate from its Marketplace, where professional traders Based on the empirical literature reviewed, the fol - lowing hypotheses are formulated: H1: here are cointegrated pairs in the cryptocur - rency markets. The popular practice is cryptocurrency traders and investors trading against time and exploiting the periodic variation in values of cryptocurrencies to make gains. Crypto arbitrage is a term that is used to describe a strategy that benefits from different prices of the same asset that is trading on another exchange. In simpler terms, a trader can take advantage of small differences or imbalance in price valuation between an asset that is listed on 2 exchanges to generate a profit. Among many bots to choose from (12 to be precise), there is an easy-to-use and profitable cryptocurrency arbitrage trading bot on Pionex. Among many bots to choose from (12 to be precise), there is an easy-to-use and profitable cryptocurrency arbitrage trading bot Cryptocurrency arbitrage is a money-making option. Table of Contents. Leveraging price variation across exchanges: The Arbitrage In cryptocurrency, traders find arbitrage opportunities by purchasing and selling crypto assets across different exchanges, allowing them to capitalize on different prices for the same asset. How Does Cryptocurrency Arbitrage Work? cryptocurrency arbitrage Triangular Arbitrage. Typically, this involves purchasing a cryptocurrency at a lower price from one exchange and selling it for a higher price on another. Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. Cryptocurrency Arbitrage Opportunities: Do They Live Up to the

Download Crypto Arbitrage for free. Cryptocurrency trading pairs function like a barter Bitcoin grew to nearly $20,000, and the high levels of kucoin xrp staticimg arbitrage Bitcoin (BTC) Price Prediction 2022 According To The Crypto Experts. Arbitrage Best Strategies for Cryptocurrency Arbitrage in 2022 Cryptocurrency arbitrage is a trading strategy that leverages price discrepancies between identical crypto assets on different markets or different cryptocurrency pairs in the reading comprehension lesson plans 5th grade new caledonia granite home depot; morris 8 for sale gumtree Defining arbitrage. Crypto Arbitrage API Documentation (WRT) | RapidAPI So, a trader might see an opportunity in arbitrage involving Bitcoin, Ethereum and XRP. Spatial ArbitragePurchase a crypto asset (e.g. Ethereum) on Exchange A with a higher priceTransfer the Ethereum, to Exchange B with a lower priceSell the Ethereum on Exchange B and profit from the difference in price H2: here are diferences in the proit poten-tials of pairs trading across cryptocurrency markets. A trader might trade BTC for ADA, convert the ADA into ETH, and then trade the ETH back to BTC. Profit - this is the profit you have made after the completion of this arbitrage transaction. There are three approaches to performing arbitrage trading in the cryptocurrency worldthey are cross-border, spatial, and statistical. Triangular arbitrage. Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. Cryptocurrency arbitrage uses the same principle of arbitrage from traditional markets. Triangular arbitrage, on the other hand, occurs on the same exchange, but it focuses on the price difference between crypto trading pairs. The main aim of the arbitrage strategy is to earn money by utilizing the Find cryptocurrency arbitrage opportunities in real-time across over 120 exchanges and 1400 pairs. It works by simultaneously buying and selling Triangular arbitrage: This complicated strategy involves trading across more than one trading pair. Ideally, the transaction is carried out the following way: Purchase of BTC for dollars; Purchase of EOS for Bitcoin; Sale of EOS for dollars. Cryptocurrency arbitrage made easy: A beginners guide market view: An overview of over 4,000 cryptocurrency pairs. Triangular arbitrage takes advantage of pricing inefficiencies between three different cryptocurrency trading pairs on the same exchange. Cryptocurrency arbitrage is a trading process that takes advantage of the price differences on the same or on different exchanges. Triangular arbitrage trading is usually more complicated as it involves trading more than a pair. How to Benefit From Crypto Arbitrage | Alexandria Arbitrage opportunities. This is also known as complex arbitrage trading. Trading information and statistics: Accurate portfolio overview, which means you don't have to manually track each configuration as the This is where you transact on both crypto exchanges and traditional currency exchanges. Cryptocurrency Arbitrage Strategies: How To 20 mins read Because they are in sequence, the initial capital will ensure the amount of each cryptocurrency in each trading pair. In a highly simplified example of how cryptocurrency arbitrage works, you would search for a specific coin thats cheaper on Exchange A than on Exchange B. Cryptocurrency Arbitrage Crypto arbitrage step by step. The term arbitrage is the purchase and sale of an asset in order to profit from a difference in the assets price between markets.. Cryptocurrency Arbitrage Monitor, search and get alerts for never-ending cryptocurrency arbitrage opportunities across various cryptocurrency exchanges including Binance, Kucoin, Bittrex, Coinbase and 20 other exchanges for Bitcoin, Ethereum, Ripple, Litecoin, Bitcoin cash, Tron, Neo, Gas and 200+ other cryptocurrency tokens. articles, investing, opinions. Yet, if you choose trading pairs with low trading activity or trade on a less popular exchange, correlation tends to lessen. Arbitrage Crypto Arbitrage Framework 28 A cryptocurrency arbitrage framework implemented with ccxt and cplex. Related Articles. Triangular arbitrage. Cryptocurrency arbitrage is gaining popularity, therefore making a smaller window of action for arbitrage merchants. Lets talk in this article about the use of pair trading for the cryptocurrency market. The Best Crypto Trading Bots for Arbitrage - BeInCrypto Our arbitrage bot allows the user to manage risks by setting up parameters for crypto trading. Lets start with the spatial method. Exchange Crypto arbitrage is a trading strategy. This 27 Best Cryptocurrency Pairs (2022) - Forex Suggest This process means reaping profit from the price differences between the three currencies. What are cryptocurrency trading pairs and how do they work? Analyzing over 10,000 crypto pairs every second, our algorithms automatically detect the coins with the strongest potential. What is Cryptocurrency Arbitrage Trading? | Cryptimi In the brief history of cryptocurrency, there have been periods of time which produced cross border arbitrage opportunities. Arbitrage Posted on October 22, 2020 in . For newbie traders, you can also participate from its Marketplace, where professional traders Based on the empirical literature reviewed, the fol - lowing hypotheses are formulated: H1: here are cointegrated pairs in the cryptocur - rency markets. The popular practice is cryptocurrency traders and investors trading against time and exploiting the periodic variation in values of cryptocurrencies to make gains. Crypto arbitrage is a term that is used to describe a strategy that benefits from different prices of the same asset that is trading on another exchange. In simpler terms, a trader can take advantage of small differences or imbalance in price valuation between an asset that is listed on 2 exchanges to generate a profit. Among many bots to choose from (12 to be precise), there is an easy-to-use and profitable cryptocurrency arbitrage trading bot on Pionex. Among many bots to choose from (12 to be precise), there is an easy-to-use and profitable cryptocurrency arbitrage trading bot Cryptocurrency arbitrage is a money-making option. Table of Contents. Leveraging price variation across exchanges: The Arbitrage In cryptocurrency, traders find arbitrage opportunities by purchasing and selling crypto assets across different exchanges, allowing them to capitalize on different prices for the same asset. How Does Cryptocurrency Arbitrage Work? cryptocurrency arbitrage Triangular Arbitrage. Typically, this involves purchasing a cryptocurrency at a lower price from one exchange and selling it for a higher price on another. Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. Cryptocurrency Arbitrage Opportunities: Do They Live Up to the  Look for new listings. Keep track of crypto forums and news sites for announcements of a new coin being added to an exchange. Dont transfer in BTC. Have a plan. Only use trusted exchanges. Monitor the market. Hedge. Diversify. Limit your exposure. This is known as crypto arbitrage. The simplest approach to cryptocurrency arbitrage is to manually monitor the prices of cryptocurrencies across a wide range of exchanges, and then make a pair of trades (both buying and selling) when you spot a discrepancy in prices. The low-risk nature of arbitrage opportunities has an impact on their profitability; less risk tends to What is Crypto Arbitrage? | Bitcoin Arbitrage Trading | Kraken Arbitrage Pair - this is the cryptocurrency pair through which the arbitrage transaction takes place, also on this line you will see the buy and sell exchanges and the prices of the given pair on these exchanges. Search: Dex Arbitrage Bot. In triangular arbitrage, traders take advantage of price differences among existing pairs on the same cryptocurrency exchange. This creates an opportunity for complex arbitrage trading, where you can exchange multiple currencies and pocket price differences. Cryptocurrency arbitrage software can be targeted at beginners and professional traders. For example, on a Crypto Arbitrage can be defined as the simultaneous buying and selling of a cryptocurrency to profit from the disbalance in price across different Cryptocurrency Arbitrage Guide: All You Since many exchanges have a number of markets with a variety of quote currency options. So a trader Cryptocurrency arbitrage allows you to take advantage of those price differences, buying a crypto on one exchange where the price is low and then immediately selling it on another exchange where the price is high.

Look for new listings. Keep track of crypto forums and news sites for announcements of a new coin being added to an exchange. Dont transfer in BTC. Have a plan. Only use trusted exchanges. Monitor the market. Hedge. Diversify. Limit your exposure. This is known as crypto arbitrage. The simplest approach to cryptocurrency arbitrage is to manually monitor the prices of cryptocurrencies across a wide range of exchanges, and then make a pair of trades (both buying and selling) when you spot a discrepancy in prices. The low-risk nature of arbitrage opportunities has an impact on their profitability; less risk tends to What is Crypto Arbitrage? | Bitcoin Arbitrage Trading | Kraken Arbitrage Pair - this is the cryptocurrency pair through which the arbitrage transaction takes place, also on this line you will see the buy and sell exchanges and the prices of the given pair on these exchanges. Search: Dex Arbitrage Bot. In triangular arbitrage, traders take advantage of price differences among existing pairs on the same cryptocurrency exchange. This creates an opportunity for complex arbitrage trading, where you can exchange multiple currencies and pocket price differences. Cryptocurrency arbitrage software can be targeted at beginners and professional traders. For example, on a Crypto Arbitrage can be defined as the simultaneous buying and selling of a cryptocurrency to profit from the disbalance in price across different Cryptocurrency Arbitrage Guide: All You Since many exchanges have a number of markets with a variety of quote currency options. So a trader Cryptocurrency arbitrage allows you to take advantage of those price differences, buying a crypto on one exchange where the price is low and then immediately selling it on another exchange where the price is high.  Here, several cryptocurrency pairs are bought to ultimately buy more of the same back with the same amount of money. Pairs are detecting Crypto Arbitrage Trading & Bitcoin Arbitrage Bots Arbitrage Cryptocurrency Guide For Beginners. CryptoCurrency Arbitrage: How Traders Make Money | Top Tips In this service, arbitrage is available for the Adventurer ($ 49 / month) and Hero ($ 99 / month) subscriptions). The first being the quick way to profit from simple exchange, with the second encompassing a wide range of options to

Here, several cryptocurrency pairs are bought to ultimately buy more of the same back with the same amount of money. Pairs are detecting Crypto Arbitrage Trading & Bitcoin Arbitrage Bots Arbitrage Cryptocurrency Guide For Beginners. CryptoCurrency Arbitrage: How Traders Make Money | Top Tips In this service, arbitrage is available for the Adventurer ($ 49 / month) and Hero ($ 99 / month) subscriptions). The first being the quick way to profit from simple exchange, with the second encompassing a wide range of options to  Consequently, initial machine-learning-based statistical arbitrage strategies have emerged in the U.S. equities markets in the academic literature, see e.g., Takeuchi and Lee (2013); Moritz and Zimmermann (2014); Krauss et al. Simply, arbitrage is like buying an item or an asset in one market and then selling it in another market at a higher price. Arbitrage Arbitrage Triangular Arbitrage: The price discrepancy among different cryptocurrency pairs always exists. Triangular arbitrage is an event which can occur on a single exchange (or across multiple exchanges) where the price differences between three difference cryptocurrencies leads to an arbitrage opportunity. Arbitrage We mentioned Gekko this is the most famous free arbitrage bot for open source cryptocurrencies, but setting it up is an extremely difficult task. Crypto Arbitrage Explained [Tutorial] - Bitsgap 5 Best Cryptocurrency Arbitrage Bots Best Crypto Arbitrage Cryptocurrency trading, bots, signals, arbitrage and portfolio - all trading tools you need with access to 25+ crypto exchanges from one interface. You can check real-time prices across hundreds of exchanges and countless trading pairs on sites like CoinMarketCap. What is Crypto Arbitrage, and How Does It Work? - Komodo Platform Pionex is an exchange that has trading bots built in. Centre to ban private cryptocurrencies Currently, the cryptocurrency market in arbitrage arbismart crypto uniswap nuanced arbi Bank of Canada Research: Cryptocurrency Arbitrage You can also do arbitrage trading outside of crypto exchanges. Cryptohopper provides unlimited cryptocurrency pairs via its autonomous mode. Arbitrage Cryptocurrency Arbitrage Cryptocurrency Arbitrage: How To Make Profit On Interexchange Trading In triangular arbitrage, traders take advantage of price differences among existing pairs on the same cryptocurrency exchange. Uniexchange Triangular Sequential Arbitrage On the Cex (Centralized Exchange), Arbisgap exploits the triangular price inefficiencies among the various Crypto pairs with a sequential uni-exchange technique. 1- Starting point if we have enough Base coin the bot will fire the first trade.

Consequently, initial machine-learning-based statistical arbitrage strategies have emerged in the U.S. equities markets in the academic literature, see e.g., Takeuchi and Lee (2013); Moritz and Zimmermann (2014); Krauss et al. Simply, arbitrage is like buying an item or an asset in one market and then selling it in another market at a higher price. Arbitrage Arbitrage Triangular Arbitrage: The price discrepancy among different cryptocurrency pairs always exists. Triangular arbitrage is an event which can occur on a single exchange (or across multiple exchanges) where the price differences between three difference cryptocurrencies leads to an arbitrage opportunity. Arbitrage We mentioned Gekko this is the most famous free arbitrage bot for open source cryptocurrencies, but setting it up is an extremely difficult task. Crypto Arbitrage Explained [Tutorial] - Bitsgap 5 Best Cryptocurrency Arbitrage Bots Best Crypto Arbitrage Cryptocurrency trading, bots, signals, arbitrage and portfolio - all trading tools you need with access to 25+ crypto exchanges from one interface. You can check real-time prices across hundreds of exchanges and countless trading pairs on sites like CoinMarketCap. What is Crypto Arbitrage, and How Does It Work? - Komodo Platform Pionex is an exchange that has trading bots built in. Centre to ban private cryptocurrencies Currently, the cryptocurrency market in arbitrage arbismart crypto uniswap nuanced arbi Bank of Canada Research: Cryptocurrency Arbitrage You can also do arbitrage trading outside of crypto exchanges. Cryptohopper provides unlimited cryptocurrency pairs via its autonomous mode. Arbitrage Cryptocurrency Arbitrage Cryptocurrency Arbitrage: How To Make Profit On Interexchange Trading In triangular arbitrage, traders take advantage of price differences among existing pairs on the same cryptocurrency exchange. Uniexchange Triangular Sequential Arbitrage On the Cex (Centralized Exchange), Arbisgap exploits the triangular price inefficiencies among the various Crypto pairs with a sequential uni-exchange technique. 1- Starting point if we have enough Base coin the bot will fire the first trade.  Crypto Arbitrage Well, not really. Cryptocurrency Arbitrage Step-by-Step Guide I CAPEX Academy From Novice to Professionals, we offer a wide range of indicators and instructors to help keep you profitable. Cryptocurrency arbitrage For example, you might trade BTC for ETH, and then sell the ETH back for BTC. Arbitrage Step 1: Collect order book data on each exchange for assets that you would like to evaluate for arbitrage. Spatial arbitrage. 3- If there are no open orders on the second pair will fire third trade. Investors use this method to buy a cryptocurrency and then A new working paper from the Bank of Canada suggests that arbitrage opportunities don't exist in the cryptocurrency markets. On the same exchange, triangular arbitrage uses the price difference between multiple cryptocurrency pairs. Crypto Arbitrage Trading: How to Arbitrage Bitcoin and other What Is Arbitrage Trading in Crypto - CoinCarp This strategy requires the investor to start with one cryptocurrency before trading it for another undervalued one compared to the former. What Are Trading Pairs in Cryptocurrency? | by Zenith Chain | Jul, Then quickly sell it on a different Selling the purchased asset at the higher price on another exchange or trading pair. In other words, the trader buys the coin cheaper from one market and sells it immediately at a more expensive price in another place. Machine learning research has gained momentum—also in finance. This is something thats been Cryptocurrency Pairs trading in cryptocurrency market: A long-short The idea of the application was to built tool for monitor (mentioned before) arbitrage in real time. While this may sound almost impossible to do manually, Bitsgap makes it look easy by combining the powers of its automated and AI-powered system. BUOYSTOCKS LTD Crypto Arbitrage: How It Works & Trading Strategies The strategy allows you to acquire a cryptocurrency from a particular exchange at a low price. July 18, 2022. intermediate. The transaction involves two exchanges: Exchange A and Exchange B DISCLAIMER: Blockchain & Cryptocurrency Is New And Risky As Investment In simple terms, crypto arbitrage occurs when an asset like Bitcoin is simultaneously bought and sold in two marketsthe same asset bought for a lower price on one exchange and sold for a higher price Trading pairs or cryptocurrency pairs Cryptocurrency arbitrage using the price difference to make money. The strategy allows you to acquire a cryptocurrency from a particular exchange at a low price. The concept of triangular arbitrage is most commonly associated with price differences in forex markets. Cryptocurrency Arbitrage: Approaches. ArbiSgaps Arbitrage Systems are based on High-Frequency Trading with artificial intelligence and extremely complex algorithms.

Crypto Arbitrage Well, not really. Cryptocurrency Arbitrage Step-by-Step Guide I CAPEX Academy From Novice to Professionals, we offer a wide range of indicators and instructors to help keep you profitable. Cryptocurrency arbitrage For example, you might trade BTC for ETH, and then sell the ETH back for BTC. Arbitrage Step 1: Collect order book data on each exchange for assets that you would like to evaluate for arbitrage. Spatial arbitrage. 3- If there are no open orders on the second pair will fire third trade. Investors use this method to buy a cryptocurrency and then A new working paper from the Bank of Canada suggests that arbitrage opportunities don't exist in the cryptocurrency markets. On the same exchange, triangular arbitrage uses the price difference between multiple cryptocurrency pairs. Crypto Arbitrage Trading: How to Arbitrage Bitcoin and other What Is Arbitrage Trading in Crypto - CoinCarp This strategy requires the investor to start with one cryptocurrency before trading it for another undervalued one compared to the former. What Are Trading Pairs in Cryptocurrency? | by Zenith Chain | Jul, Then quickly sell it on a different Selling the purchased asset at the higher price on another exchange or trading pair. In other words, the trader buys the coin cheaper from one market and sells it immediately at a more expensive price in another place. Machine learning research has gained momentum—also in finance. This is something thats been Cryptocurrency Pairs trading in cryptocurrency market: A long-short The idea of the application was to built tool for monitor (mentioned before) arbitrage in real time. While this may sound almost impossible to do manually, Bitsgap makes it look easy by combining the powers of its automated and AI-powered system. BUOYSTOCKS LTD Crypto Arbitrage: How It Works & Trading Strategies The strategy allows you to acquire a cryptocurrency from a particular exchange at a low price. July 18, 2022. intermediate. The transaction involves two exchanges: Exchange A and Exchange B DISCLAIMER: Blockchain & Cryptocurrency Is New And Risky As Investment In simple terms, crypto arbitrage occurs when an asset like Bitcoin is simultaneously bought and sold in two marketsthe same asset bought for a lower price on one exchange and sold for a higher price Trading pairs or cryptocurrency pairs Cryptocurrency arbitrage using the price difference to make money. The strategy allows you to acquire a cryptocurrency from a particular exchange at a low price. The concept of triangular arbitrage is most commonly associated with price differences in forex markets. Cryptocurrency Arbitrage: Approaches. ArbiSgaps Arbitrage Systems are based on High-Frequency Trading with artificial intelligence and extremely complex algorithms.